Henry, Julia Roberts’ “beautiful” son, turns 17 today: a rare look at her youngest Julia Roberts celebrated her youngest son’s 17th birthday on Instagram with a beautiful picture. Despite the unexpected image—Julia is typically known to be reticent about her children—she and her spouse have previously revealed incredible photos of Henry Moder that have left people in awe.ư

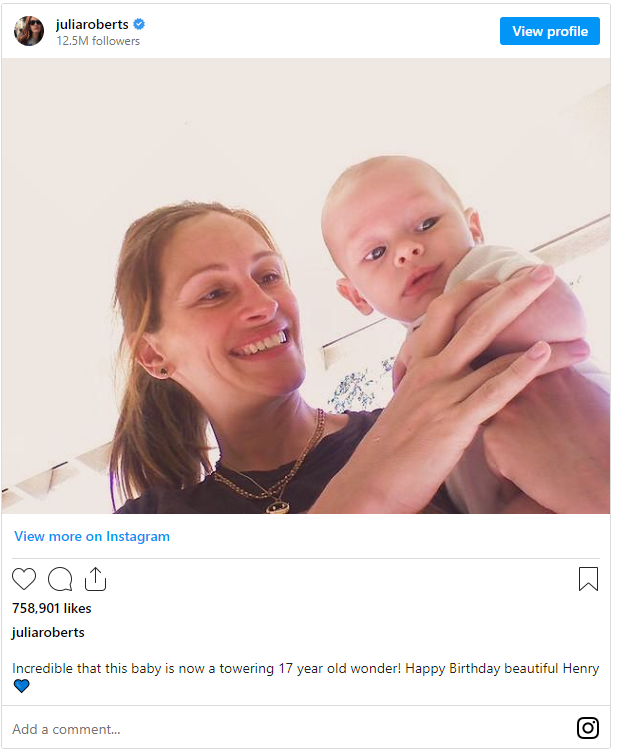

Date: June 29, 2024 Writer: James William None to say Henry, Julia Roberts’ “beautiful” son, turns 17 today: a rare look at her youngest Julia Roberts celebrated her youngest son’s 17th birthday on Instagram with a beautiful picture. Despite the unexpected image—Julia is typically known to be reticent about her children—she and her spouse have previously revealed incredible photos of Henry Moder that have left people in awe. A very happy birthday to the kid of Hollywood’s most renowned couple, Julia Roberts and Daniel Moder! Henry Moder, the youngest member of their family, turned seventeen on June 18. A flurry of encouraging remarks have been left on social media by his loving mother, who celebrated the joyous occasion with a number of beautiful mother-son messages. In the photo, the “Pretty Woman” actress is seen looking down at Henry, who is still a newborn. Her eyes are shining with delight and affection. The curious and charming baby seems absorbed in something outside of the frame, cradled in his mother’s protective arms.

Julia expressed both her pride and her shock in a succinct yet beautiful caption she penned for the picture. It’s incredible how this little child has developed into a fantastic 17-year-old! She wrote, “Happy Birthday, Henry! You are beautiful.” Although Julia and Henry’s father, Daniel, respect their children’s privacy, on occasion the pair provides exclusive photos and videos of their children. Daniel in particular has been entertaining fans on social media with videos of Henry, Hazel, and Phinnaeus Moder enjoying a good time, showcasing precious family moments.

Daniel posted a video on Instagram of Henry showing off his skating skills at a skate park. In the slow-motion video, the child can be seen riding his skateboard up an incline while wearing dark pants and an olive-colored t-shirt.Henry succeeds in turning the board around at the top of the ramp, putting his gorgeous face in the frame of the camera. Then, when the camera pans closer, his attractive eyes and face are shown in close-up.Daniel shared the incredible footage on June 18, 2021, in observance of Henry’s 14th birthday. The springs twist and swirl, swaying fourteen times in the air. Ya Henry,” the proud father captioned the photo.

In the post’s comment area, followers of the now-17-year-old were applauding and thanking him in addition to sharing their thoughts on which parent Henry most resembled. “He looks just like you. Nice child, said one of his supporters.In agreement, a second person remarked, “Looks precisely like his Dad!lovely offspring While acknowledging the father-son likeness, the other individual also highlighted Henry’s mother, remarking, “Has mom’s hair.” There is no denying that child. Hehe.On the other hand, a commenter on Instagram said, “This family obviously has no Roberts genes at all!” Once more, after Henry’s father-lookalike shared an earlier picture of his child on social media, people swarmed to the comments area.

Henry is seen in the 2018 picture posing casually stylish in a lighthouse. The boy on skates looked down at the camera, his long hair falling in a carefree way to frame his face.”Look closely to see the star spangled shorts,” Daniel captioned the surreal picture. One cool young person…Happy Fourth of July from a lighthouse near the Cape. Beneath the picture, an admirer remarked, “Handsome Henry,” and another, “Julia’s eyes.”Whether or not Henry and his siblings look alike, Julia is still incredibly in love with them. She has often boasted about them and places her responsibilities as a mother above all else.

During an interview promoting her latest movie, “Ticket to Paradise,” Julia was asked how she defined herself as a homemaker by the interviewer. “When I’m not working, that’s my full-time job,” stated the mother of three. Though it’s not all sunshine and kittens, I am really delighted about it.

She also discussed her unique bond with Henry, whom she refers to as her breakfast partner as they both benefit much from that most important meal of the day. I love breakfast, thus it’s my favorite meal. My morning buddy is my younger son Henry,” Julia remarked.The interviewer was so aware of the “Notting Hill” actress’s love of breakfast that they made a joke about how the interview would keep her from eating with Henry Moder. Yes, in fact! We love eating breakfast! With a smile, Julia Roberts concurred.

Julia loves her twins Phinnaeus and Hazel in addition to Henry. As her lone daughter joined her father, a cinematographer, at the 2021 Cannes Film Festival to promote his film “Flag Day,” Julia spoke affectionately about Hazel. The audience was captivated by the father-daughter exchange and shocked by how much Daniel looked like her.Hazel, then sixteen, wore a stylish yet laid-back outfit for the well-known event. She wore black Mary Janes with big heels and a yellow button-down dress with floral lace embroidery. Her fair hair was likewise tied back into a ponytail by her. On the other hand, her father looked dapper in a black suit.Hazel’s parents, especially her mother, expressed her happiness with her behavior, praising her for her excellent behavior. Recalling the exceptional event, Julia praised her daughter and made fun of their arguments on her appearance and her self-assured refusal to apply eyeliner, remarking, “That girl is unique.”The innocence really is so lovely.

When fans saw pictures of the young lady on her father’s arm, they complimented Hazel’s looks and labeled her pretty, but they also made note of the physical differences between Julia and Hazel. “She’s lovely but you’d never guess who her mom is…they really are not alike at all,” a supporter commented.

Another person said something like, “She doesn’t look anything like her Mum.” While some people stated that Hazel resembles her father more than Julia, others pointed out that the two are not the same. Even while many people thought Hazel and Julia didn’t look identical, many still complimented the 19-year-old on her good looks.

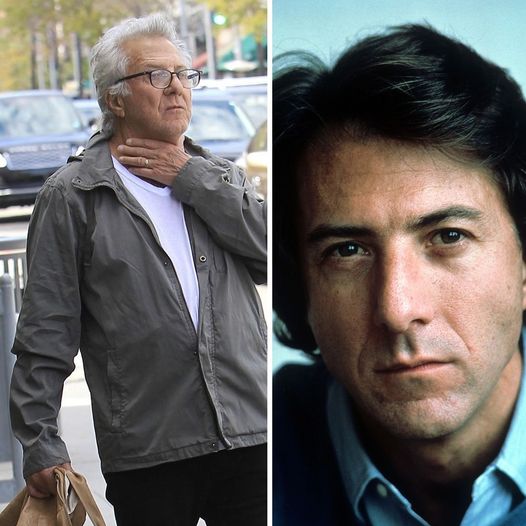

Dustin Hoffman’s Secret Cancer Battle: The Untold Story of His Triumph!

Dustin Hoffman, known for his roles in movies like “Tootsie” and “Rain Man,” kept a big secret about his health. In 2013, when he was 75 years old, he shared that he had been treated for throat cancer. He didn’t talk about it after that.

Hoffman became famous in 1967 with his role in “The Graduate.” He got nominated for an Oscar for that movie. After that, he starred in more famous films like “All the President’s Men” in 1976 and “Kramer vs. Kramer” in 1979, where he won an Oscar for Best Actor.

In 1983, he was in “Tootsie,” where he played a man who pretends to be a woman to get an acting job.

In the famous movie where Dustin Hoffman dressed up as a woman, he was called a “nottie” instead of a “hottie,” which made him very sad.

He said in an interview, “If I was going to be a woman, I would want to be as beautiful as possible, and they said to me, ‘That’s as good as it gets.’ Uh, that’s as beautiful as we can get you.”

When he heard that he wasn’t considered very pretty, it made him really upset. This made him realize something important about how women are treated.

“I went home and started crying,” Hoffman says. “I think I’m an interesting woman, when I look at myself on-screen, and I know that if I met myself at a party I would never talk to that character because she doesn’t fulfill, physically, the demands that we’re brought up to think women have to have in order for us to ask them out.”

Even though the comedy he was in was the second most popular movie that year – “E.T. The Extraterrestrial” was number one – Dustin Hoffman didn’t find it funny.

He said, “…that was never a comedy for me.”

But despite that, Hoffman became one of the most famous actors in Hollywood.

He won his second Oscar for the 1988 movie “Rain Man” and also won six Golden Globes and one Primetime Emmy.

In 2013, the actor, who is usually busy with his career, became quiet.

Just a few months after Dustin Hoffman directed the British comedy “Quartet” in 2012, and shortly after finishing filming “Chef” in 2014 with Jon Favreau and Sofia Vergara, his representative told the world why the beloved actor had been out of the spotlight.

His publicist, Jodi Gottlieb, shared with People (through ABC News) that Hoffman had been successfully treated for cancer, something he had kept private. She said, “It was detected early, and he has been surgically cured. Dustin is feeling great and is in good health.”

Although not much detail was given, reports suggested he had throat cancer. Even though he was 75 at the time, he continued with treatments to prevent it from coming back.

But Hoffman didn’t let this slow him down. He continued to work, lending his voice to Master Shifu in more “Kung Fu Panda” movies and starring in other films like “Sam and Kate” in 2022 and the sci-fi drama “Megalopolis” in 2024.

In early March 2024, Hello! reported that Hoffman and his wife Lisa Gottsegen, whom he married in 1980, were seen walking together in London, showing affection.

They wrote, “The Hollywood legend looked years younger than 86 as he smiled and waved at the cameras. He was tanned and carefree as he strolled through the city and ducked into boutiques with his wife of 43 years.“

Although Hoffman hasn’t spoken publicly about his cancer battle, it seems he’s doing well. Let us know what you think of this story and share it so we can hear what others think too!

Leave a Reply